TSX: TML

OTCQX: TSRMF

Results include 66.56 g/t over 5.5 metres, 12.70 g/t over 4.6 metres and 7.07 g/t over 6.9 metres

Highlights:

- Results from 27 holes for the Goldlund Gold Project 2021 drilling campaign released today include significant intersections both within the PEA resource zone and along strike. Selected drill results include:

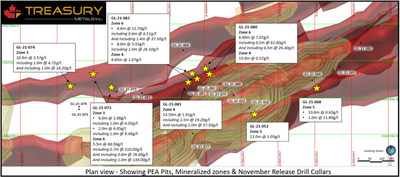

- Hole GL-21-073 intersected 5.50 m grading 66.56 g/t Au, including 0.70 m grading 210.00 g/t Au, 0.80 m grading 78.40 g/t Au and 1.00 m grading 138.00 g/t Au in Zone 6 from 22.5 m to 28 m downhole;

- Hole GL-21-082 intersected 4.60 m grading 12.70 g/t Au, including 0.6 m grading 6.51 g/t Au and 1.40 m grading 37.50 g/t Au in Zone 6 from 140.4 m to 145 m downhole and also intersected 8.00 m grading 3.53 g/t Au, including 1.00 m grading 26.10 g/t Au in Zone 6 from 155 m to 163 m downhole;

- Hole GL-21-080 intersected 6.90 m grading 7.07 g/t Au, including 0.50 m grading 61.20 g/t Au and 0.50 m grading 26.40 g/t Au from 282 m to 288.9 m downhole in Zone 6;

- Hole GL-21-081 intersected 23.50 m grading 1.91 g/t Au, including 1.50 m grading 19.20 g/t Au and 1.00 m grading 10.60 g/t in Zone 4 from 25.5 m to 49.0 m downhole

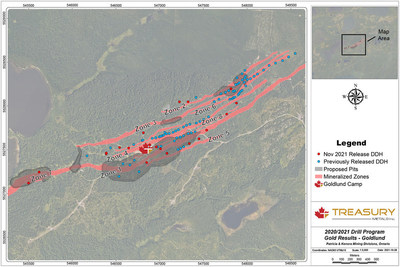

TORONTO, Nov. 3, 2021 /CNW/ - Treasury Metals Inc. (TSX: TML) (OTCQX: TSRMF) (“Treasury” or the “Company”) is pleased to announce results from an additional 4,000 metres from 27 holes of a planned 22,000 metre diamond drilling program for 2021 at the Goldlund Gold Deposit (“Goldlund”) located within the larger 100% owned Goliath Gold Complex (the “Project” or “GGC”), which includes the Goliath, Goldlund and Miller deposits along a prospective 65-kilometre trend in Northwestern Ontario.

The Company has drilled approximately 22,200 metres (123 holes) to date at Goldlund. Following the results released today, gold assays are pending on 5,200 metres (21 holes) at Goldlund. Drilling in 2021 at Goldlund was primarily focused on infill and expansion drilling in the main Goldlund PEA pit design footprint; however, the program also targeted near surface, on strike extensions of mineralization. Drill results today are a combination of infill and expansion drill holes throughout the Goldlund project testing all mineralized zones.

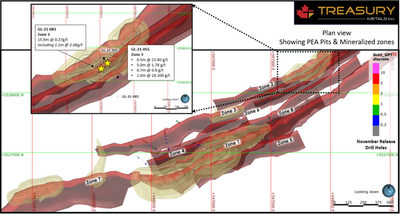

Jeremy Wyeth, President and CEO of Treasury Metals, commented: “We are pleased to report additional drill results from our 2021 Goldlund drilling campaign that show several high grade intervals and the extension into Zone 6, which lies outside to the northwest of the main Goldlund PEA pit. The results show good mineralization of near surface material that can potentially allow for the expansion of the pits and increase our confidence in our resource model.”

Hole GL-21-073 was targeting inter-zone mineralization related to Zone 6 as well as Zone 3. This hole was a 130 metre step out to the northwest in the footwall of the main PEA Pit. The hole intersected 5.50 m grading 66.56 g/t Au including 0.70 m grading 210.00 g/t Au, 0.80 m grading 78.40 g/t Au and 1.00 m grading 138.00 g/t Au on the inter-zone mineralization related to Zone 6 at the hanging wall contact of a felsic intrusive unit. The geology team is working to better understand the relationship of this intrusive felsic dyke rock and the mafic to intermediate volcanic rocks that host Zone 4, 5, 6 and 8. A litho-structural review on the controls of mineralization in the area is underway, using structural and geochemical data from this year’s program.

Holes GL-21-080, GL-21-81 and GL-21-082 were drilled targeting Zone 4 following up on June and July’s Zone 4 results as infill holes approximately 25 metres in the footwall of the main PEA Pit. Each of these holes intersected Zone 4 mineralization which can be seen in Table 1.

Holes GL-21-080 and GL-21-082 were drilled to reach Zone 6 located in the footwall approximately 30 metres from Zone 4. The Treasury team is pleased to see that Zone 6 also showed promising results, where hole GL-21-082 intersected 4.60 m grading 12.70 g/t Au, including: 0.6 m grading 6.51 g/t Au and 1.40 m grading 37.50 g/t Au from 140.4 m to 145 m downhole. Hole GL-21-082 also intersected 8.00 m grading 3.53 g/t Au, including 1.00 m grading 26.10 g/t Au in Zone 6 from 155 m to 163 m downhole. Also, from Zone 6, hole GL-21-080 intersected 6.90 m grading 7.07 g/t Au, including: 0.50 m grading 61.20 g/t Au and 0.50 m grading 26.40 g/t Au. Results in Zone 6 from GL-21-080 and GL-21-082 were associated with mafic flows adjacent to felsic intrusive dykes. Improving the geological model for this mineralization is ongoing work for the team into 2022.

Additional positive results were returned for Zone 5 this month, including GL-21-052 intersecting 13.00 m grading 1.05 g/t Au. The new results come as the follow up Zone 5 infill drill program wrapped up in October, which tested the on strike continuity from positive results released in September.

Drilling is ongoing at the Goldlund Wild Cat Exploration targets (Ocelot and Caracal) located approximately halfway between Goldlund and Miller. This first pass drill program of approximately 1,800 metres will test two geophysical anomies with similar signatures to Goldlund and Miller.

Table 1: New Significant Intercepts

|

Drill Hole |

Zone |

From (m) |

To (m) |

Sample Length (m) |

Grade g/t Au |

|

|

GL-21-052 |

Zone 5 |

137.00 |

150.00 |

13.00 |

1.05 |

|

|

GL-21-055 |

Zone 3 |

25.25 |

25.75 |

0.50 |

22.80 |

|

|

GL-21-055 |

Zone 3 |

70.00 |

71.00 |

1.00 |

18.30 |

|

|

GL-21-068 |

Zone 5 |

50.00 |

60.60 |

10.60 |

0.63 |

|

|

GL-21-068 |

Zone 5 |

101.00 |

102.10 |

1.10 |

11.80 |

|

|

GL-21-073 |

Zone 6 |

22.50 |

28.00 |

5.50 |

66.56 |

|

|

including |

22.50 |

23.20 |

0.70 |

210.00 |

||

|

and including |

23.20 |

24.00 |

0.80 |

78.40 |

||

|

and including |

24.00 |

25.00 |

1.00 |

138.00 |

||

|

GL-21-073 |

Zone 6 |

36.80 |

63.80 |

27.00 |

0.37 |

|

|

GL-21-073 |

Zone 3 |

157.00 |

163.00 |

6.00 |

2.08 |

|

|

including |

161.00 |

162.00 |

1.00 |

4.05 |

||

|

GL-21-073 |

Zone 3 |

171.00 |

173.00 |

2.00 |

6.05 |

|

|

including |

171.00 |

172.00 |

1.00 |

9.48 |

||

|

GL-21-074 |

Zone 3 |

142.00 |

153.00 |

10.90 |

2.57 |

|

|

including |

148.00 |

149.00 |

1.00 |

4.72 |

||

|

and including |

150.00 |

151.00 |

1.00 |

16.20 |

||

|

GL-21-080 |

Zone 4 |

165.10 |

181.00 |

15.90 |

0.37 |

|

|

GL-21-080 |

Zone 6 |

282.00 |

288.90 |

6.90 |

7.07 |

|

|

including |

282.00 |

282.50 |

0.50 |

61.20 |

||

|

and including |

282.50 |

283.00 |

0.50 |

26.40 |

||

|

Zone 6 |

294.00 |

294.50 |

0.50 |

5.92 |

||

|

GL-21-081 |

Zone 4 |

25.50 |

49.00 |

23.50 |

1.91 |

|

|

including |

25.50 |

27.00 |

1.50 |

19.20 |

||

|

and including |

46.00 |

47.00 |

1.00 |

10.60 |

||

|

GL-21-082 |

Zone 4 |

66.00 |

68.10 |

2.10 |

1.74 |

|

|

GL-21-082 |

Zone 4 |

79.40 |

88.00 |

8.60 |

1.07 |

|

|

GL-21-082 |

Zone 6 |

134.00 |

136.00 |

2.00 |

1.12 |

|

|

Zone 6 |

140.40 |

145.00 |

4.60 |

12.70 |

||

|

including |

140.40 |

141.00 |

0.60 |

6.51 |

||

|

and including |

143.60 |

145.00 |

1.40 |

37.50 |

||

|

GL-21-082 |

Zone 6 |

155.00 |

163.00 |

8.00 |

3.53 |

|

|

including |

162.00 |

163.00 |

1.00 |

26.10 |

|

Note: Reported intervals are drilled core lengths and do not indicate true widths. For duplicate samples, the original sample gold assays are used to calculate the intersection grade. All grades are un-capped |

Complete results from the 2020/2021 drill program at Goldlund can be found here on the Treasury Metals website.

QA / QC

The Company has implemented a quality assurance and quality control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The drill core is sawn in half with one-half of the core sample dispatched to Activation Laboratories Ltd. facility located in Dryden, Ontario. The other half of the core is retained for future assay verification and/or metallurgical testing. Other QA/QC procedures include the insertion of blanks and Canadian Reference Standards for every tenth sample in the sample stream. A quarter core duplicate is assayed every 20th sample. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream. Additional checks are routinely run on anomalous values including gravimetric analysis and pulp metallic screen fire assays. Gold analysis is conducted by lead collection, fire assay with atomic absorption and/or gravimetric finish on a 50-gram sample. Check assays are conducted at a secondary ISO certified laboratory (in this case AGAT Laboratories located in Mississauga, Ontario) following the completion of a program.

Qualified Persons

Maura Kolb, M.Sc., P.Geo., Director of Exploration and Adam Larsen, P. Geo., Exploration Manager, are both considered as a “Qualified Person” for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), and have reviewed and approved the scientific and technical disclosure contained in this news release on behalf of Treasury.

About Treasury Metals Inc.

Treasury Metals Inc. is a gold focused company with assets in Canada. Treasury’s Goliath Gold Complex, which includes the Goliath, Goldlund and Miller deposits, is located in Northwestern Ontario. The deposits benefit substantially from excellent access to the Trans-Canada Highway, related power and rail infrastructure, and close proximity to several communities including Dryden, Ontario. The Company also owns several other projects throughout Canada, including the Lara Polymetallic Project, Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. Treasury Metals is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including: creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community well-being.

For information on the Goliath Gold Complex, please refer to the preliminary economic assessment, prepared in accordance with NI43–101, entitled “NI 43–101 Technical Report & Preliminary Economic Assessment of the Goliath Gold Complex: and dated March 10, 2021 with an effective date of January 28, 2021, led by independent consultants Ausenco Engineering Canada Inc. The technical report is available on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.treasurymetals.com.

To view further details about Treasury, please visit the Company’s website at www.treasurymetals.com.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This release includes certain statements that may be deemed to be “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expect, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “intends”, “estimates”, “envisages”, “potential”, “possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Actual results or developments may differ materially from those in forward-looking statements. Treasury disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for precious metals; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of resource estimates; health, safety and environmental risks; worldwide demand for gold and base metals; gold price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

Actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits may be derived therefrom and accordingly, readers are cautioned not to place undue reliance on the forward-looking information.

Note to United States Investors

All resource estimates included in this pess release have been prepared in accordance with Canadian standards, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” that may be used or referenced are Canadian mining terms as defined in accordance with National Instrument 43 101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves (the “CIM Standards”). The CIM Standards differ significantly from standards in the United States. While the terms “mineral resource,” “measured mineral resources,” “indicated mineral resources,” and “inferred mineral resources” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves. Readers are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, United States companies are only permitted to report mineralization that does not constitute “reserves” by standards in the United States as in place tonnage and grade without reference to unit measures. Accordingly, information regarding resources contained or referenced in this [name of disclosure document] containing descriptions of our mineral deposits may not be comparable to similar information made public by United States companies.

SOURCE Treasury Metals Inc.

Contact

Jeremy Wyeth, President & CEO, T: +1 416 214 4654; Orin Baranowsky, CFO, T: +1 416 214 4654, Email: info@treasurymetals.com, Twitter @TreasuryMetals