TSX: TML OTCQX: TSRMF

Highlights:

- Continuity of near surface, Goliath-style alteration and gold mineralization with significant silver confirmed between drillholes and extended up dip.

- Mineralization intersected includes:

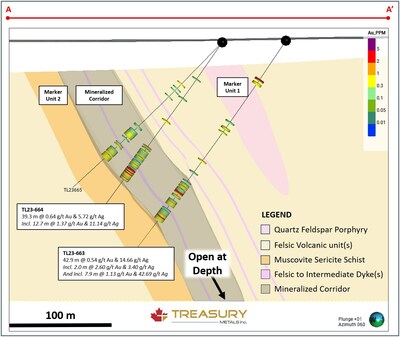

- TL23-663 intersected 42.9 metres grading 0.54 g/t Au and 14.66 g/t Ag, including 2.0 metres grading 2.60 g/t Au and 3.40 g/t Ag, and 7.9 metres grading 1.13 g/t Au and 42.69 g/t Ag which includes 1.0 metre grading 4.64 g/t Au and 191.00 g/t Ag;

- TL23-664 intersected 39.3 metres grading 0.64 g/t Au and 5.72 g/t Ag, including 12.7 metres grading 1.37 g/t Au and 11.14 g/t Ag, which includes 1.0 metre grading 5.53 g/t Au and 30.30 g/t Ag;

- TL23-661 intersected 18.0 metres grading 0.70 g/t Au and 2.94 g/t Ag, including 2.0 metres grading 2.34 g/t Au and 8.65 g/t Ag, and 1.0 metre grading 3.32 g/t Au and 2.40 g/t Ag;

- TL23-668 intersected 25.0 metres grading 0.50 g/t Au and 12.14 g/t Ag, including 4.0 metres grading 1.24 g/t Au and 38.03 g/t Ag, and 1.0 metre grading 4.07 g/t Au and 75.60 g/t Ag;

- TL22-644 intersected 5.7 metres grading 2.25 g/t Au and 1.58 g/t Ag, including 1.5 metres grading 8.12 g/t Au and 2.50 g/t Ag, and also intersected 10.5 metres grading 0.74 g/t Au and 24.77 g/t Ag, including 1.5 metres grading 1.97 g/t Au and 47.30 g/t Ag;

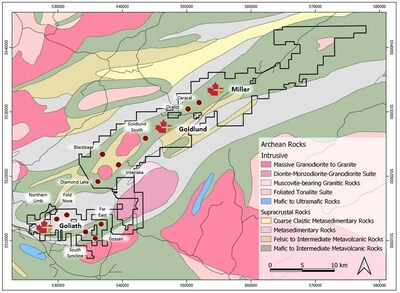

TORONTO, Feb. 29, 2024 /CNW/ - Treasury Metals Inc. (TSX: TML) (OTCQX: TSRMF) (“Treasury” or the “Company”) is pleased to announce additional results from the Far East drill program, which was a follow up program that aimed to confirm the continuity of mineralization across the 600 metre, Goliath-style target defined by drilling conducted in previous exploration programs.

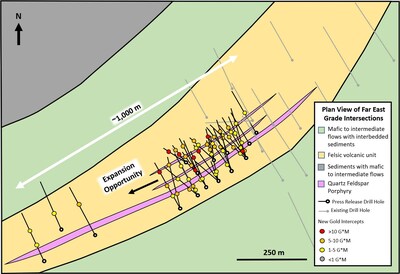

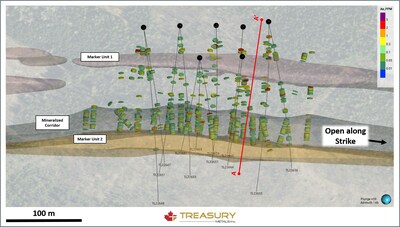

The drilling represented in this release occurred across two phases. The initial phase of the program (20 holes, 5,427 metres) was designed to confirm the continuity of the host lithology and mineralization between existing drilling, expand along strike and up dip, and further the geological understanding of the Goliath-style target. The second phase (14 holes, 3,078 metres) aimed to further expand known mineralization along strike and up dip, and step out further to the southwest along trend to explore the potential extent of the host rock lithology. Drilling from both phases successfully intersected the targeted lithology and mineralization adjacent to and between past drilling, extending the identified mineralized trend to approximately 1 kilometre and improved definition of 400 metres.

Jeremy Wyeth, President and CEO of Treasury Metals, commented: “These confirmatory results at Far East demonstrate the continuity of this near surface target. The exploration site is located less than 8 kilometres from the proposed processing plant for the Goliath Gold Complex, which presents the opportunity for material that can potentially extend and expand the mine life, further enhancing the value from the positive PFS released on the project in 2023. In addition, the silver included at the Far East and those to be integrated in the next resource update at Goldlund, which historically has not been incorporated, may broaden the material available to be processed. The results today confirm the exploration potential on our 100% owned 330 sq km Goliath Gold Complex, and we believe that more examples like Far East will be found and provide new opportunities for growth with further exploration on the district-scale property package”.

The Far East target is located approximately 8 kilometres east of the Goliath deposit and was initially identified in 2011. The Company completed a four-hole test program on the target in 2012, with the last hole intersecting Goliath-style host rock, alteration and mineralization. Drilling in 2021 and 2022 on the target was undertaken to better understand the shape, extent, and mineralization potential of the host rock. The mineralization at the Far East target occurs within felsic to intermediate volcanic rocks and is associated with disseminated pyrite and trace sphalerite, both of which are characteristic of the Goliath deposit. At the Far East it has been observed that elevated gold results are typically located near and along the contacts of felsic porphyry intrusions. While not directly associated with Goliath mineralization, deformed porphyries are commonly identified in the hanging wall sediments above the deposit and could have played a role in fluid movement and the original emplacement of gold. In addition to gold, significant silver results have been intersected and generally correlate to the presence of elevated gold values. High-grade intercepts like those found in TL22-616 where 16.90 g/t Au over 9.0 metres including 0.3 metres grading 502.00 g/t Au (released May, 2022) occur as remobilized mineralization in quartz veins within the host lithologies.

In the most recent program, the geological team drilled a series of holes between the wider-spaced holes from the previous program, and up and down dip. Due to the wet ground conditions, “swamp mats” were utilized and multiple holes were drilled at each location to prevent excess ground disturbance. The increase in drill density assisted in confirming the continuity of the mineralization, but also identified several new mineralized horizons and relationships. Multiple felsic to intermediate intrusive rocks were intersected across the area where the mineralization is spatially related to the contacts, though not mineralized themselves. The southeast-most and thickest of the felsic intrusive rocks logged as quartz feldspar porphyry has a strong magnetic signature which is identifiable in airborne geophysical maps and is a great marker horizon for future exploration as it continues to the southwest. TL22-644 returned 5.7 metres grading 2.25 g/t Au and 1.58 g/t Ag, including 1.5 metre grading 8.12 g/t Au and 2.50 g/t Ag, adjacent to the hanging wall contact of this porphyry in addition to other mineralized intervals along strike. A set of sub-metre felsic to intermediate dykes identified in the stratigraphy has been observed to relate to wider mineralized intervals where TL23-663 intersected 42.9 metres grading 0.54 g/t Au and 14.66 g/t Ag, including 2.0 metres grading 2.60 g/t Au and 3.40 g/t Ag and 7.9 metres grading 1.13 g/t Au and 14.66 g/t Ag, which includes 1.0 metre grading 4.64 g/t Au and 191.00 g/t Ag; TL23-664 intersected 39.3 metres grading 0.64 g/t Au and 5.72 g/t Ag, including 12.7 metres grading 1.37 g/t Au and 11.14 g/t Ag, which includes 1.0 metre grading 5.53 g/t Au and 30.30 g/t Ag; and TL23-668 intersected 25.0 metres grading 0.50 g/t Au and 12.14 g/t Ag, including 4.0 metres grading 1.24 g/t Au and 38.03 g/t Ag, and including 1.0 metre grading 4.07 g/t Au and 75.60 g/t Ag. Furthermore, these wide intervals of mineralization occur immediately above a strongly silicified quartz-phyric muscovite sericite schist, providing an easily identifiable footwall marker unit.

On the southwest side, TL23-672, was drilled approximately 85 metres along strike to previously released drillhole TL22621 and encountered the host lithologies and mineralized intervals with 8.9 metres grading 0.67 g/t Au and 3.41 g/t Ag, including 1.0 metre grading 3.79 g/t Au and 20.80 g/t Ag, associated with the upper porphyry; and 36.0 metres grading 0.35 g/t Au and 7.92 g/t Ag, including 0.6 metre grading 1.07 g/t Au and 51.30 g/t Ag, associated with the lower porphyry. Three additional drillholes were designed as step-outs between 325 to 500 metres further along strike to investigate the extent of the host lithologies. While the full lithological sequence was not encountered, small intervals of the host rock lithology were found with gold present. Future programs will investigate the expansion potential in the area between these holes (see Figure 2) in addition to deeper drilling as the mineralized corridor remains open at depth.

Table 1: New Significant Gold and Silver Intercepts from Recent Drilling

|

Drill Hole |

Including |

From (m) |

To (m) |

Sample Length (m) |

Au (g/t) |

Ag (g/t) |

|

TL22-644 |

40.81 |

46.50 |

5.69 |

2.25 |

1.58 |

|

|

including |

43.50 |

45.00 |

1.50 |

8.12 |

3.75 |

|

|

TL22-644 |

180.51 |

191.00 |

10.49 |

0.74 |

24.77 |

|

|

including |

185.00 |

186.50 |

1.50 |

1.97 |

47.30 |

|

|

TL23-657 |

175.00 |

195.60 |

20.60 |

0.53 |

5.50 |

|

|

including |

175.00 |

176.00 |

1.00 |

1.47 |

7.40 |

|

|

and |

178.00 |

179.00 |

1.00 |

1.39 |

6.50 |

|

|

TL23-659 |

133.50 |

152.00 |

18.50 |

0.54 |

10.71 |

|

|

including |

144.00 |

144.50 |

0.50 |

4.46 |

96.00 |

|

|

TL23-661 |

104.00 |

122.00 |

18.00 |

0.70 |

2.94 |

|

|

including |

105.00 |

107.00 |

2.00 |

2.34 |

8.65 |

|

|

and |

121.00 |

122.00 |

1.00 |

3.32 |

2.40 |

|

|

TL23-662 |

93.50 |

115.00 |

21.50 |

0.41 |

14.85 |

|

|

including |

107.00 |

108.00 |

1.00 |

2.68 |

24.90 |

|

|

TL23-663 |

170.00 |

212.90 |

42.90 |

0.54 |

14.66 |

|

|

including |

178.00 |

180.00 |

2.00 |

2.60 |

3.40 |

|

|

and |

205.00 |

212.90 |

7.90 |

1.13 |

42.69 |

|

|

including |

208.00 |

209.00 |

1.00 |

4.64 |

191.00 |

|

|

TL23-664 |

124.00 |

163.33 |

39.33 |

0.64 |

5.72 |

|

|

including |

150.66 |

163.33 |

12.67 |

1.37 |

11.14 |

|

|

including |

153.00 |

154.00 |

1.00 |

5.53 |

30.30 |

|

|

TL23-668 |

71.00 |

96.00 |

25.00 |

0.50 |

12.14 |

|

|

including |

73.00 |

77.00 |

4.00 |

1.24 |

38.03 |

|

|

and |

95.00 |

96.00 |

1.00 |

4.07 |

75.60 |

|

|

TL23-668 |

121.45 |

128.75 |

7.30 |

1.14 |

3.20 |

|

|

including |

128.00 |

128.75 |

0.75 |

6.80 |

18.90 |

|

|

TL23-672 |

182.00 |

218.00 |

36.00 |

0.35 |

7.92 |

|

|

including |

195.10 |

195.70 |

0.60 |

1.07 |

51.30 |

|

Note: Reported intervals are drilled core lengths and do not indicate true widths. |

Complete gold and silver results from the 2022 and 2023 exploration-focused drill program at the Far East can be found here on the Treasury Metals website.

QA / QC

The Company has implemented a quality assurance and quality control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The drill core is sawn in half with one-half of the core sample dispatched to Activation Laboratories Ltd. facility located in Dryden, Ontario. The other half of the core is retained for future assay verification and/or metallurgical testing. Other QA/QC procedures include the insertion of blanks and Canadian Reference Standards for every tenth sample in the sample stream. A quarter core duplicate is assayed every 20th sample. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream. Additional checks are routinely run on anomalous values including gravimetric analysis and pulp metallic screen fire assays. Gold analysis is conducted by lead collection, fire assay with atomic absorption and/or gravimetric finish on a 50-gram sample. Check assays are conducted at a secondary ISO certified laboratory (in this case AGAT Laboratories located in Mississauga, Ontario) following the completion of a program.

Qualified Person

Adam Larsen, B.Sc., P. Geo., Director of Exploration, is considered a “Qualified Person” for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and approved the scientific and technical disclosure contained in this news release on behalf of Treasury.

About Treasury Metals Inc.

Treasury Metals Inc. is a gold-focused company with assets in Canada. Treasury’s Goliath Gold Complex (which includes the Goliath, Goldlund and Miller deposits) is located in Northwestern Ontario. The deposits benefit substantially from excellent access to the Trans-Canada Highway, related power and rail infrastructure and close proximity to several communities including Dryden, Ontario. For information on the Goliath Gold Complex, please refer to the technical report, prepared in accordance with NI 43–101, entitled “Goliath Gold Complex – NI 43–101 Technical Report and Prefeasibility Study” and dated March 27, 2023 with an effective date of February 22, 2023, led by independent consultants Ausenco Engineering Canada Inc. The technical report is available on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.treasurymetals.com.

The Company also owns several other projects throughout Canada, including the Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. Treasury Metals is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community well-being. For further details about Treasury, please visit the Company’s website at www.treasurymetals.com.

Cautionary Note Regarding Forward-Looking Information

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively, forward-looking statements”) within the meaning of Canadian and United States securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “potential”, “feasibility”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for precious metals; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of resource estimates; health, safety and environmental risks; worldwide demand for gold and base metals; gold price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations. Actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits may be derived therefrom and accordingly, readers are cautioned not to place undue reliance on the forward-looking information.

Cautionary Note to United States Investors

The Company is subject to the reporting requirements of applicable Canadian securities laws, and as a result, reports information regarding mineral properties, mineralization and estimates of Mineral Reserves and Mineral Resources in accordance with Canadian reporting requirements, which are governed by Canadian National Instrument NI 43-101. As such, the information included in this news release concerning mineral properties, mineralization and estimates of Mineral Reserves and Mineral Resources may not be comparable to similar information disclosed by U.S. public companies subject to the reporting and disclosure requirements of U.S. regulators. Historical results or pre-feasibility models presented herein are not guarantees or expectations of future performance.

SOURCE Treasury Metals Inc.

Contact

Jeremy Wyeth, President & CEO; Orin Baranowsky, CFO, Treasury Metals Inc., T: +1 416-214-4654; Toll-free: +1-855-664-4654, Email: ir@treasurymetals.com; Twitter: @treasurymetals